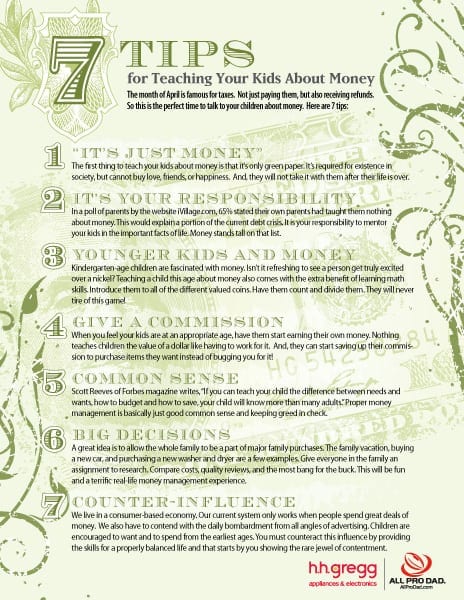

The month of April is famous for taxes. Not just paying them, but also receiving funds. So this is the perfect time to talk to your children about money. Here are 7 tips to do that!

1. “It’s not your money.”

The first thing to teach your kids about money is that it’s only green paper. It’s required for existence in society, but cannot buy love, friends, or happiness. And, they will not take it with them after their life is over.

2. It’s your responsibility.

In a poll of parents by the website iVillage.com, 65% stated their own parents had taught them nothing about money. This would explain a portion of the current debt crisis. It is your responsibility to mentor your kids in the important facts of life. Money stands tall on that list.

3. Younger kids and money.

Kindergarten-age children are fascinated with money. Isn’t it refreshing to see a person get truly excited over a nickel? Teaching a child this age about money also comes with the extra benefit of learning math skills. Introduce them to all of the different valued coins. Have them count and divide them. They will never tire of this game!

4. Give a commission.

When you feel your kids are at an appropriate age, have them start earning their own money. Nothing teaches children the value of a dollar like having to work for it. And, they can start saving up their commission to purchase items they want instead of bugging you for it!

5. Common sense.

Scott Reeves of Forbes magazine writes, “If you can teach your child the difference between needs and wants, how to budget and how to save, your child will know more than many adults.” Proper money management is common sense and keeping greed in check.

6. Big decisions.

A great idea is to allow the whole family to be a part of major family purchases. The family vacation, buying a new car, and purchasing a new washer and dryer are a few examples. Give everyone in the family an assignment to research. Compare costs, quality reviews, and the most return on investment. This will be fun and a terrific real-life money management experience.

7. Counter-influence.

We live in a consumer-based economy. Our current system only works when people spend great deals of money. We also have to contend with the daily bombardment from all angles of advertising. Children are encouraged to want and to spend from the earliest ages. You must counteract this influence by providing the skills for a properly balanced life and that starts by you showing the rare jewel of contentment.